Our Investment Approach

We seek to invest in Real Estate as one of our asset class categories as a sustainable investment solution.

What we are Investing In

- Land

- Commercial Real Estate

- Multifamily

Investment Assets in Perspective

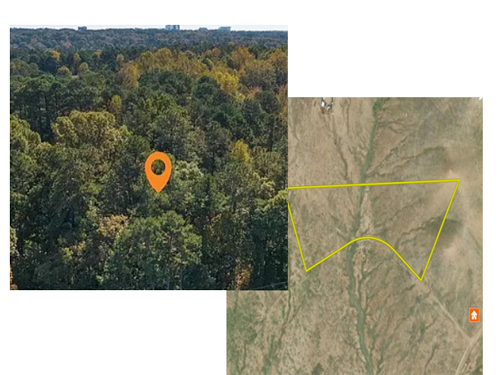

Land

Unlike stocks or other financial instruments, land is a tangible asset that you can see and touch. This can provide a sense of security and stability that other investments may not

We highly believe in land compared to other types of real estate investments, there is relatively low competition in the land market. This can make it easier to find good deals and get a good return on your investment.

Investing in land is a good way for us to diversify our investment portfolio and reduce our overall risk. This is because land values tend to be less volatile than other types of investments.

We plan to put the land we buy for a variety of purposes, such as farming, ranching, recreation, or development.

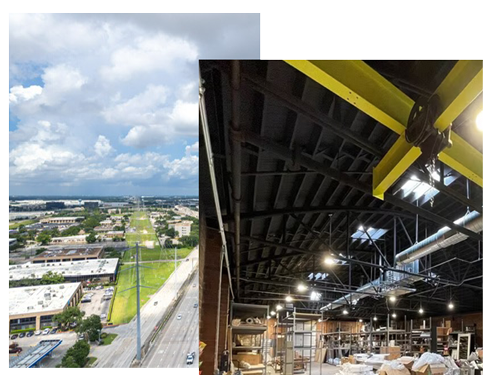

Commercial Real Estate

Investing in commercial real estate is part of our 5 year blueprint.

In addition, we believe investing directly in commercial real estate can offer assets that can appreciate and provide cash flow.

The average annual return of commercial real estate over 20 years is roughly 9.5%, nearly 1% greater than the S&P 500’s average annual return of 8.6% over the same period of time.

Investing in commercial real estate in America can be a smart move for many reasons and that is why we believe we will play a huge part of actively investing in this market.

Multifamily

We also a 5 year plan to to invest in multifamily real estate, owning and operating residential properties with multiple rental units. We believe in providing housing for different communities and help the government in reducing housing shortage for low and medium earning families.

Rental income from multiple units can also provide a steady and reliable cash flow, helping investors maintain a consistent income over time.

Multifamily investments allow for diversification across multiple units or properties, reducing risk compared to investing in a single-family home. This diversification can help mitigate the impact of vacancies or other issues in a single unit.